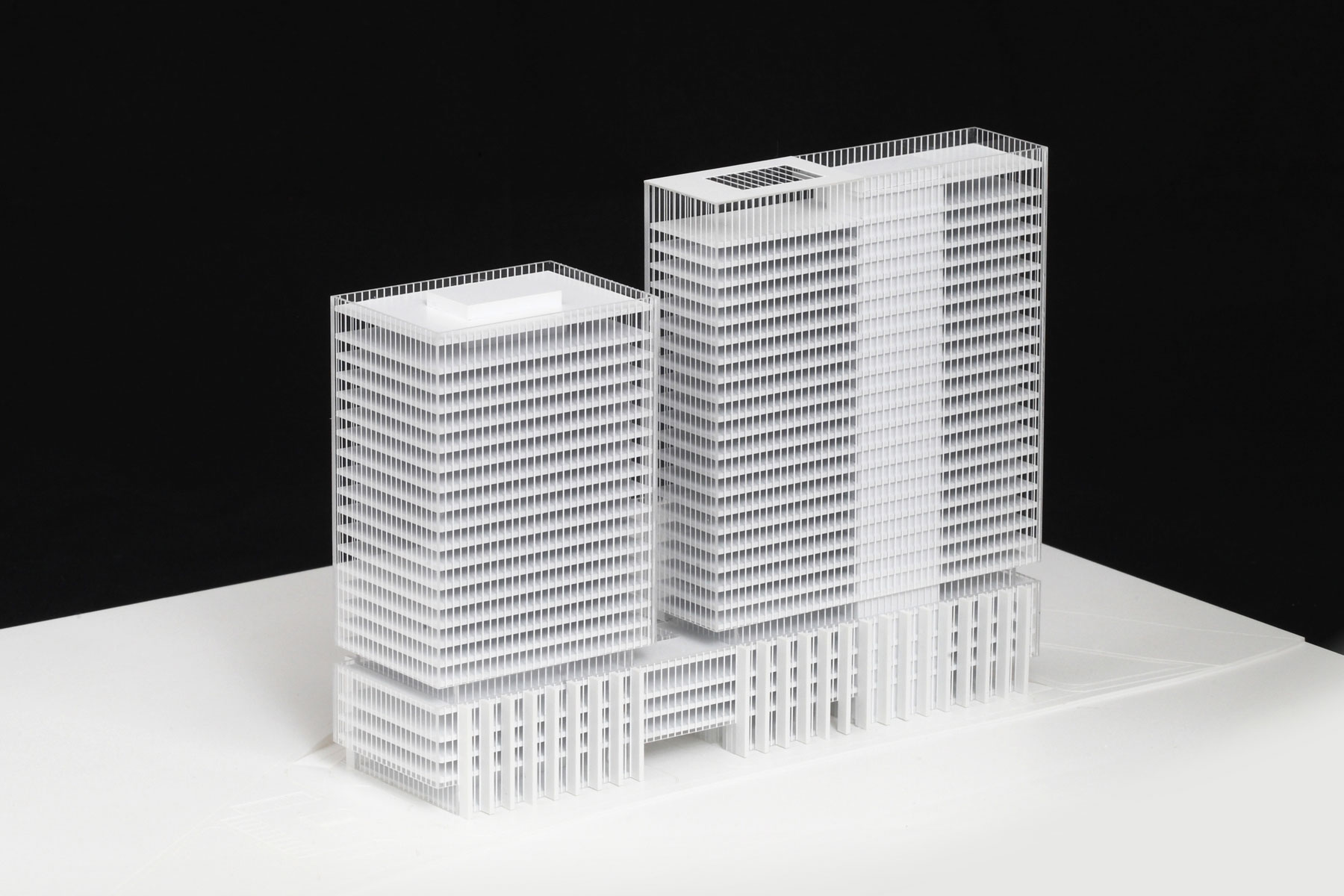

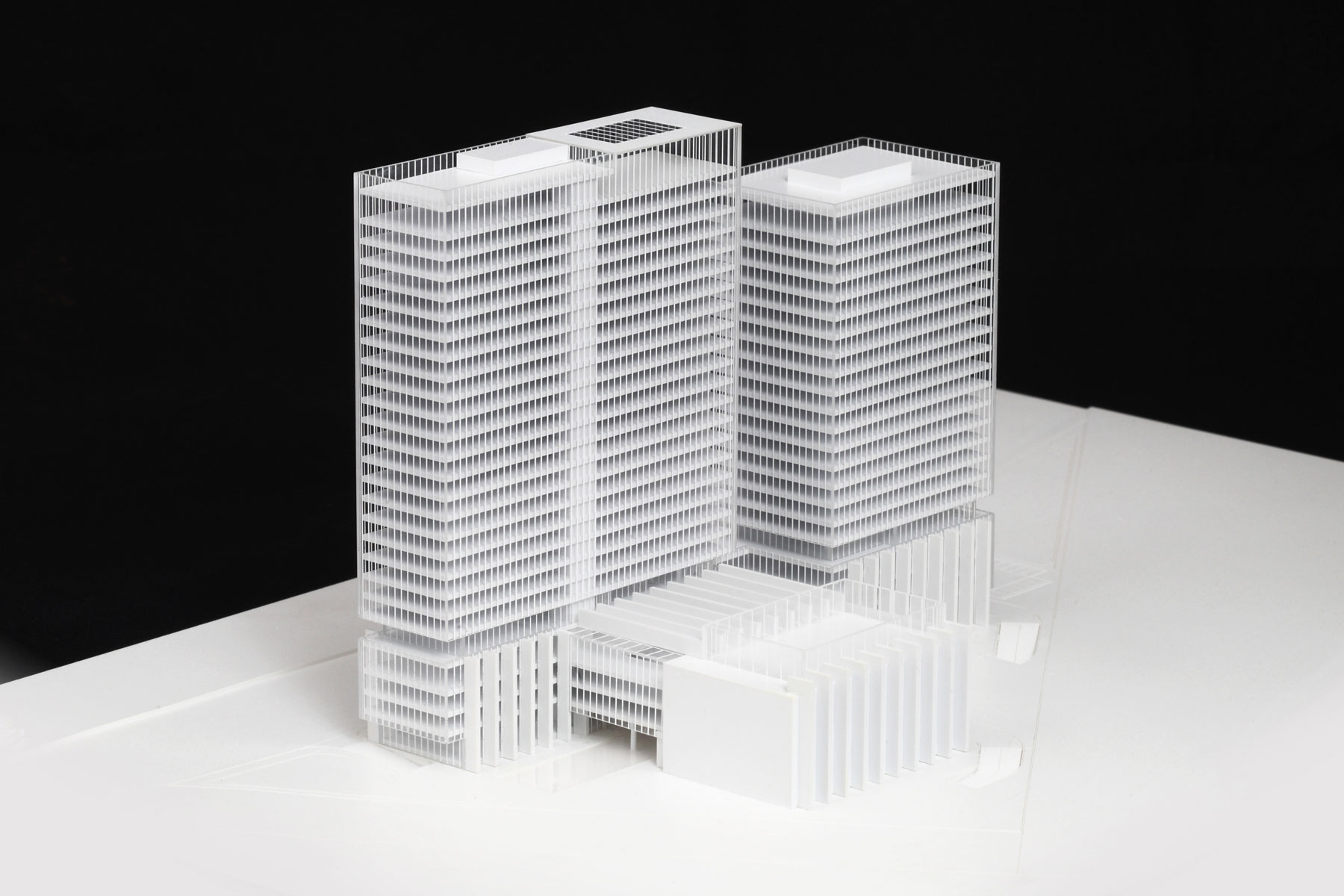

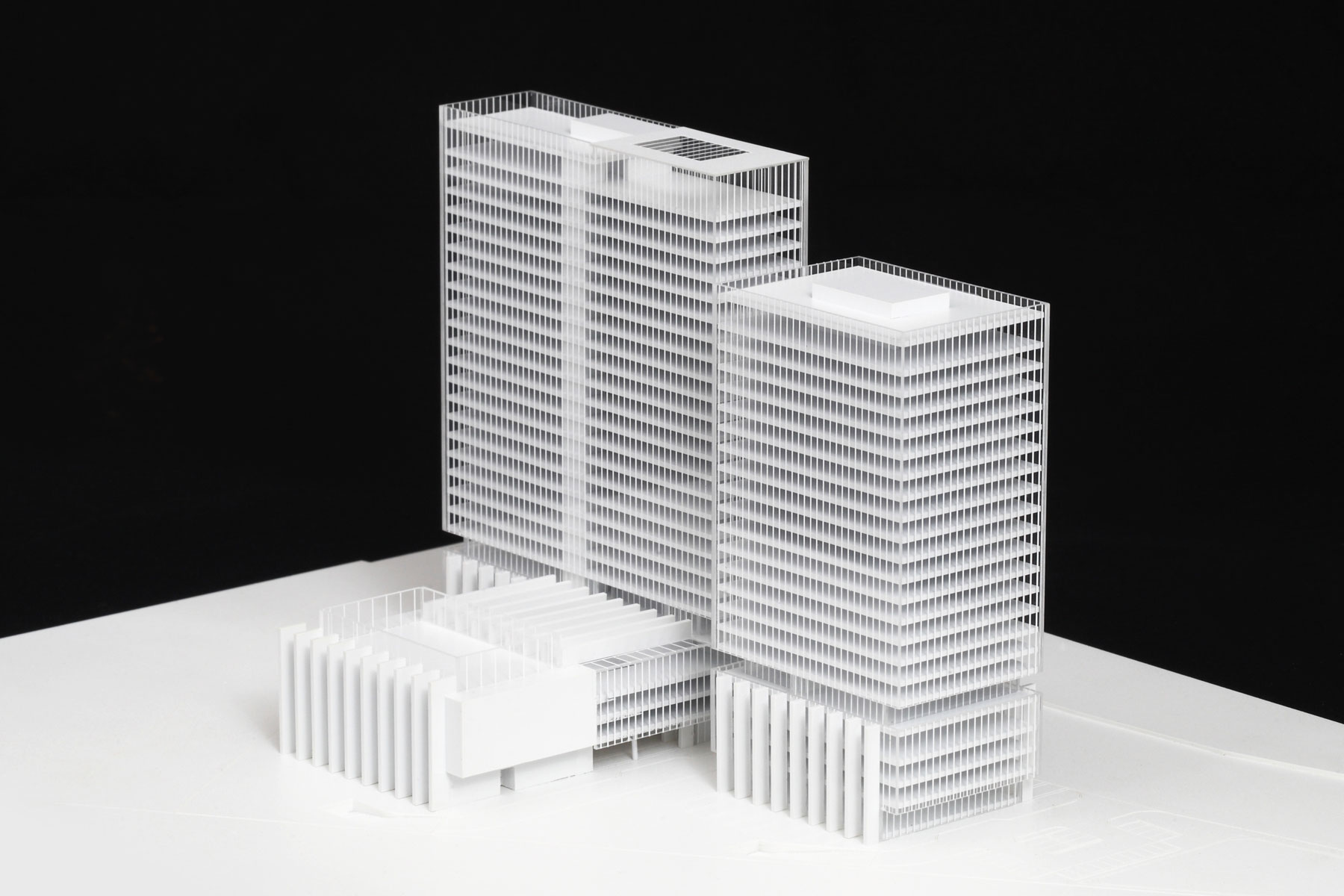

The area plan for the project is 21F/B4 in scale, with a ground floor area (GFA) of 83,063.89㎡.

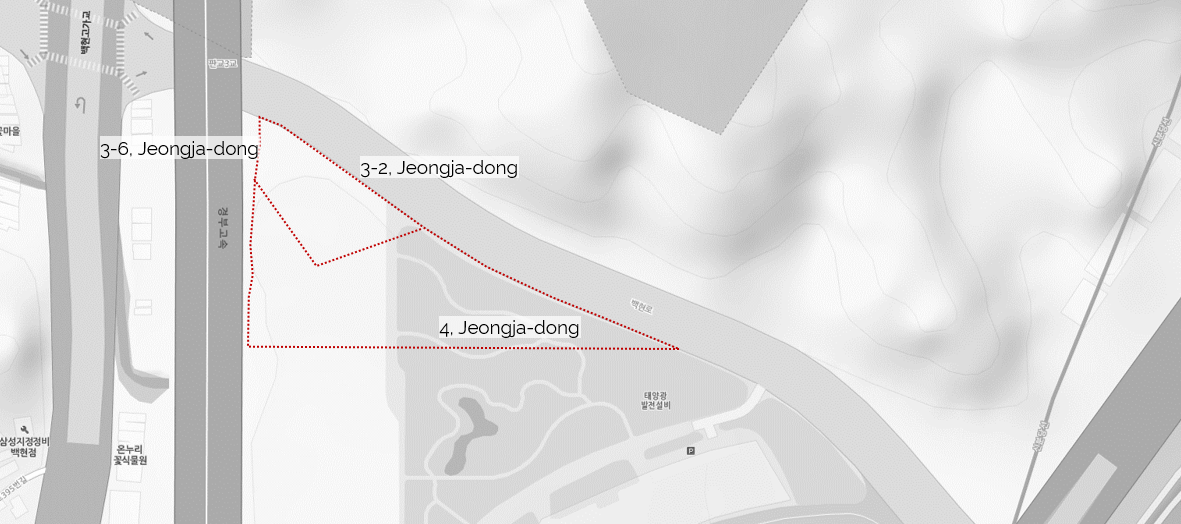

| Location | 3-2, 3-6, 4, Jeongja-dong, Bundang-gu, Seongnam-si, Gyeonggi-do |

| Land Area | 18,884.20㎡ |

| District Use | General commercial area, first development district |

| Construction Area | 5,455.88㎡ |

| Total Floor Area | 83,063.89㎡ |

| Ground Level | 53,949.74㎡ |

| Underground Level | 29,114.15㎡ |

| Building Coverage | 28.89% (Legal standard within 80%) |

| Floor Area Ratio | 285.69% (Legal standard within 800%) |

| Construction Scale | Total of 3 buildings. hotel (432 rooms, B4F~21F), Residence hotel (170 rooms, B4F~19F) Convention building(B3F~3F) |

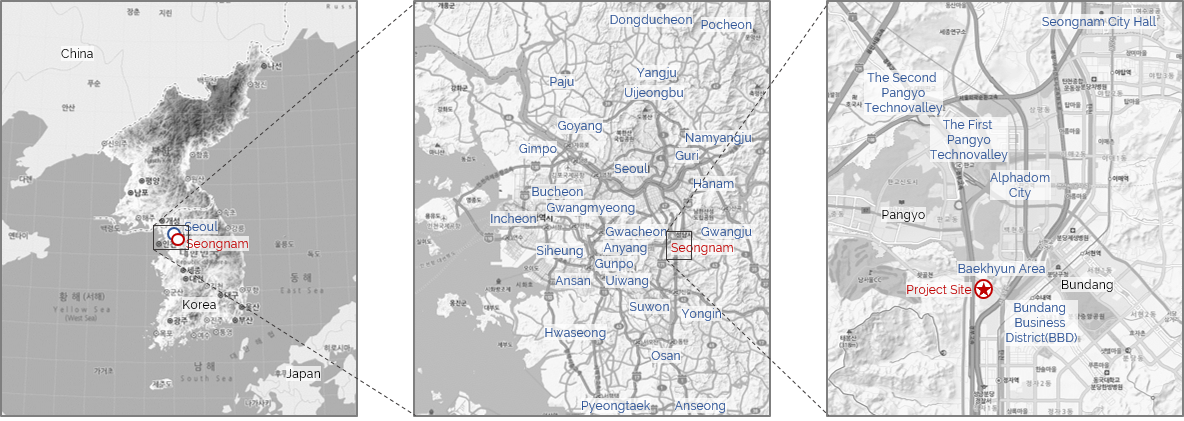

4, Jeongja-dong, Bundang-gu, Seongnam-si, Gyeonggi-do, Republic of Korea

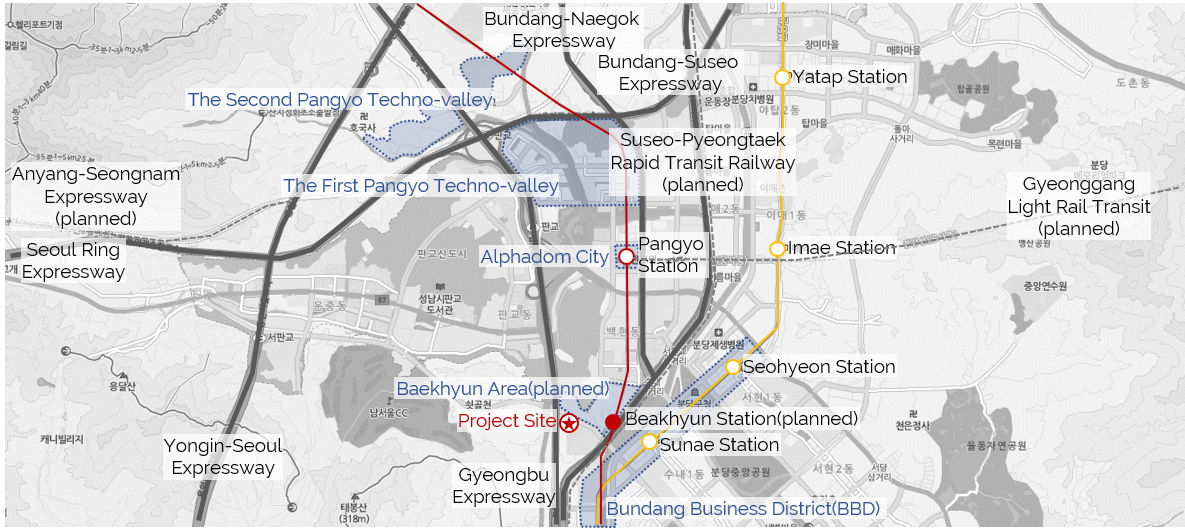

The project site has a high potential for growth due to its convenient location and accessibility through various subway lines and expressways, as well as due to several main development plans nearby.

The site is located near the expected sites of the Alphadom City and the Second Pangyo techno-valley, and among High Tech Industrial Complexes such as the Bundang IT Valley.The site is conveniently accessible through the Gyeongbu Expressway and Bundang-Suseo Expressway among others, and through the well-developed public transportation network such as via the Shinbundang line and the Bundang line.

Location

Features

| Location |

- Prime location surrounded by the Business District of Pangyo, Sunae subway station, and Jeongja subway station. - Several major conglomerates have plans to relocate to Bundang Business District (BBD). - Convenient vehicle accessibility through Gyeongbu Expressway, Bundang-Suseo Expressway, etc. - Well-developed public transportation infrastructure such as Shinbundang subway line and Bundang subway line. - Adjacent to the First Pangyo techno-valley and Korea Job World. |

|

| HotelDemand |

- No luxury high-end hotel located nearby (as of August 2016). - Increasing number of businesses (especially businesses with more than 100 employees) and employees in Seoul Pangyo. - Increasing number of overseas tourists and long-staying tourists. |

|

| ExpectedDevelopmentPlans |

- Alphadom City (2022E). · 137,497㎡ complex development project nearby Pangyo Station. · Residential / office / commercial facilities (Samsung C&T Corporation and Hyundai Department Store opened recently). - The Second Pangyo techno-valley (2022E). · Multiple complex development project connecting the First Pangyo techno-valley and Alphadom City. · Target global firms’ (including Chinese firms) R&D centers. - Baek-hyun area / station (planned). · Office / convention / commercial facilities. - Transportation Infrastructure Development Plans. · Bundang line nad Shinbundang line connection plan. |

The site comprises of 3 lots located in a general commercial area, with a total size of 18,884.2㎡. The current owner is Seoul Pangyo and the developer has secured the land-use right through a leasing agreement with Seoul Pangyo.

The site comprises of 3 lots of public land, located in a general commercial district.Besitz, the developer, has signed a 30-year-leasing agreement on the project site with Seoul Pangyo on November 13, 2015.Besitz Comprehensive Development Ltd has the Right of First Offer (ROFO) to purchace the land before the lease ends.

Land Decree

Summary

| Location | Lot # | Land Area(㎡) | Regional District | Ownership |

| Jeongja-dong, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea | 3-2 | 4,971.7 | General Commercial District | Public Asset |

| Jeongja-dong, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea | 3-6 | 88.3 | General Commercial District | Public Asset |

| Jeongja-dong, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea | 4 | 13,824.2 | General Commercial District | Public Asset |

| Total | 18,884.2 |

The project goal is to develop and operate a competitive luxury and residential hotel, which provides a differentiated hotel service. The planned grand opening is in August 2022.

Business Goal

| Value-added Creation |

- Develop and operate a distinguished luxury hotel by utilizing the public land of Seoul Pangyo. - Devise a highly profitable business plan by focusing on the value of the constructed asset and reducing unnecessary costs. |

|

| Competitive Luxury hotel |

- Absorb the existing latent demand for a luxury hotel and the demand for an extended-stay residential hotel in the area. - Maximize operational efficiency and secure hotel value through prestigious global brand affiliation. |

|

| Differentiated Hotel Service |

- Satisfy various customer needs by providing luxurious hotel facilities and services at a reasonable price range. - Host distinctive events in the Convention Center located in the annex building. |

The concept of the project is to create a “Future-oriented Cultural Complex Space” representing Southern Gyeonggi-do, by developing and operating a 602-room high-end luxury hotel along with a convention center facility.

The development concept is to create a space composed of a luxury hotel and a convention center in order to meet various customer needs.

Development Concept

| Size |

- 602 rooms (hotel 432 rooms, residence hotel 170 rooms) |

|

| Development Concept |

- Futuristic cultural complex space representing the southern part of Gyeonggi-do; locational advantage, differentiated service, reasonable price, professional operation and more. |

|

| Differentiation Strategy |

- Create quality city-space which could targets various customer needs; business, tourism, cultural, leisure and more. · Prestigious global brand affiliation. · Separate convention center to hold various cultural events, including international meetings, concerts, exhibitions, etc. · Differentiated additional facilities including spa facilities, F&B and more. |

Space Composition Plan

| Classification | |||

| 2nd basement | - Nail shop - Wedding shop - Hair shop - Flower shop - Jewelry shop - Tailor shop - Souvenir shop - Convenient sotre |

- Car center | |

| 1st basement | - Restaurant - Coffee & Bakery lounge |

- Art gallery - Sales facility |

- Banquet hall |

| 1st floor | - Buffet restaurants - Restaurant |

- Party rooms - Coffee & Bakery lounge - Wine bar - Convenient store |

- Banquet hall |

| 2nd floor | - Fitness club - Sauna - Indoor Swimming pool - Lounge |

- Indoor Golf ground - Restaurants - Spa |

- GX room |

| 3rd floor | - Reception - Club lounge |

- Smart office |

- Tennis court |

| 4th ~ 20th floor | - Room(432) | - 4th ~ 19th floor : Room(170) | |

| 21th floor | - Sky lounge & Bar - Meeting rooms |

||

The project will be operated by a consigned global hotel operator to enhance asset value and to maximize operational efficiency.

Maximizing operational efficiency through hotel consignment operation and providing differentiated high-end services at a reasonable price range.

Consignment Operation Overview

| Definition |

- Based on consignment operation agreement with business owner, the operator shares their brand name and dispatches its skilled employees for the contracted period. |

|

| Strength |

- Operational Efficiency · Stable operation leads to stable profit, and eventually leads to Break-Even Point of the business at shorter period. · Acquisition of standardized operating system. · Enhancement of asset value and financial solvency. - Brand value · Utilization of prestigious global hotel brand. · Facilitation of promotion at the early stage of operation. - Human resource · Securement of skilled human resources and know-how. |

Room Composition Plan

| Classification | Room Type | # of room | Composition Ratio | Area/room(㎡) | Gross Area(㎡) | Area Ratio | |

| High-endluxury Hotel | A-1 Type | 307 | 51.00% | 32.81 | 10,071.74 | 33.90% | |

| A-2 Type | 51 | 8.47% | 30.58 | 1,559.58 | 5.25% | ||

| B Type | 49 | 8.14% | 47.62 | 2,333.36 | 7.85% | ||

| C Type | 17 | 2.82% | 64.61 | 1,098.37 | 3.70% | ||

| D Type | 2 | 0.33% | 122.98 | 245.96 | 0.83% | ||

| E Type | 6 | 1.00% | 66.31 | 397.85 | 1.34% | ||

| Sub Total | 432 | 71.76% | 15,706.86 | 52.86% | |||

| ResidenceHotel | F Type | 66 | 10.96% | 34.10 | 2,250.28 | 7.57% | |

| G Type | 4 | 0.66% | 60.50 | 242.00 | 0.81% | ||

| H Type | 8 | 1.33% | 32.86 | 262.84 | 0.88% | ||

| I Type | 30 | 4.98% | 144.69 | 4,340.70 | 14.61% | ||

| J Type | 30 | 4.98% | 97.52 | 2,925.60 | 9.85% | ||

| K Type | 30 | 4.98% | 130.58 | 3,3917.40 | 13.18% | ||

| L Type | 2 | 0.33% | 34.09 | 68.18 | 0.23% | ||

| Sub Total | 170 | 28.24% | 14,007.00 | 47.14% | |||

| Total | 602 | 100.00% | 29,713.86 | 100.00% |

Area by Facility

| Classification | High-end luxury hotel | Residence hotel | Convention | Total | |

| Room | 15,706.86 | 14,007.00 | - | 29,713.86 | |

| Room | 15,706.86 | 14,007.00 | - | 29,713.86 | |

| Auxiliary Facilities | 5,497.94 | 2,818.11 | 1,881.93 | 10,197.98 | |

| F&B | 9,041.76 | 827.45 | - | 3,869.21 | |

| Fitness Center | 1,400.68 | 152.35 | 305.91 | 1,858.94 | |

| Banquet | 439.16 | 237.49 | 1,576.02 | 2,252.67 | |

| Arcade | 506.00 | - | - | 506.00 | |

| Other Facilities | 110.34 | 1,600.82 | - | 1,711.16 | |

| Common Facility | 26,338.22 | 14,784.32 | 2,029.51 | 43,152.05 | |

| Public Department | 11,295.00 | 6,153.89 | 1,305.96 | 18,754.85 | |

| Management Facility | 6,811.34 | 2,198.52 | 723.55 | 9,733.41 | |

| Parking Facilities | 8,231.88 | 6,431.91 | - | 14,663.79 | |

| Total | 47,543.02 | 31,609.43 | 3,911.44 | 83,063.69 |

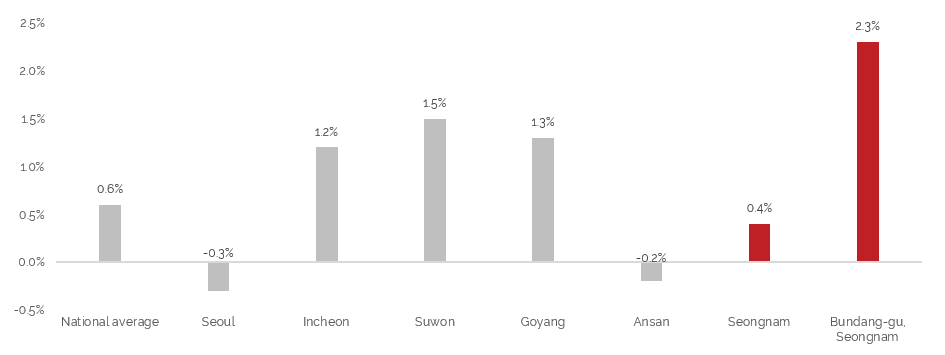

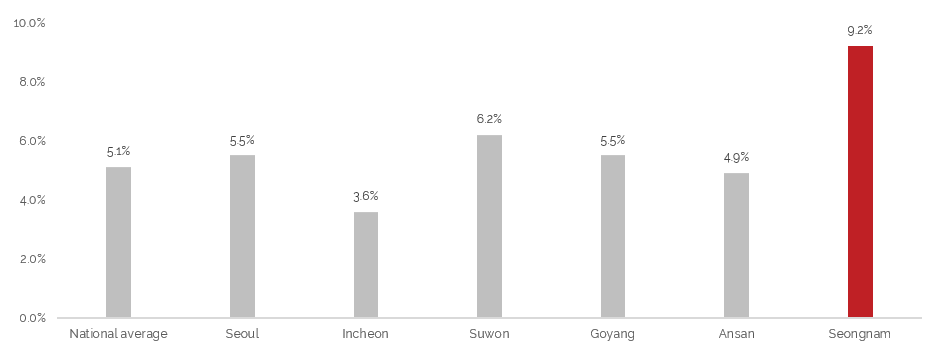

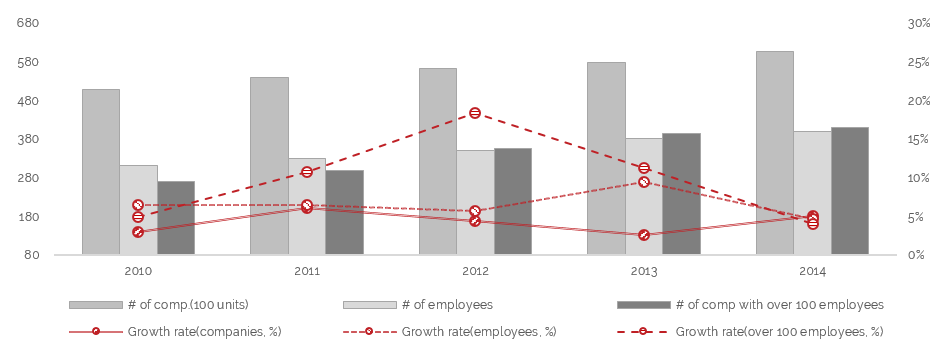

The demographical and economic indicators of Seoul Pangyo show that the city’s industry has outgrown other major cities, especially in virtue of rapid growth of Bundang district including BBD/Pangyo.

Despite the relatively slow growth in overall population of Seoul Pangyo, the growth rate of Bundang district (where the project site is located) has highly outgrown other major cities including Seoul and Incheon.

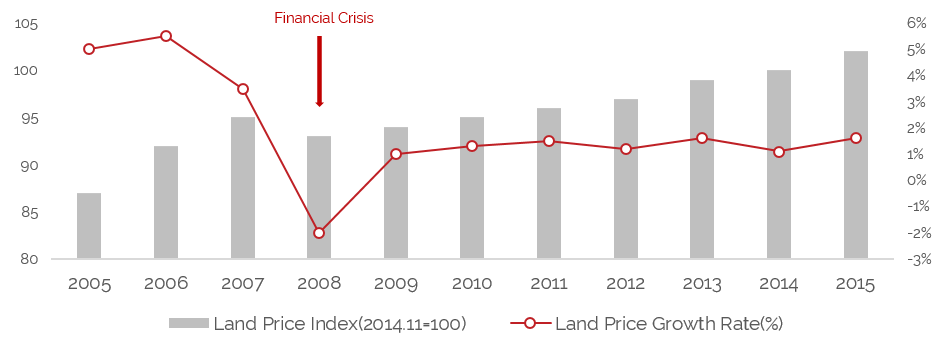

The economic indicators including GRDP and the Land Price Index of Seoul Pangyo have shown stable and rapid growth over the past years.

Demographics of Seoul Pangyo and the Other Major Cities(2008~2015)

GRDP Growth Rate of the Major Cities(2008~2015)

Land Price Index of Seoul Pangyo(2005~2015)

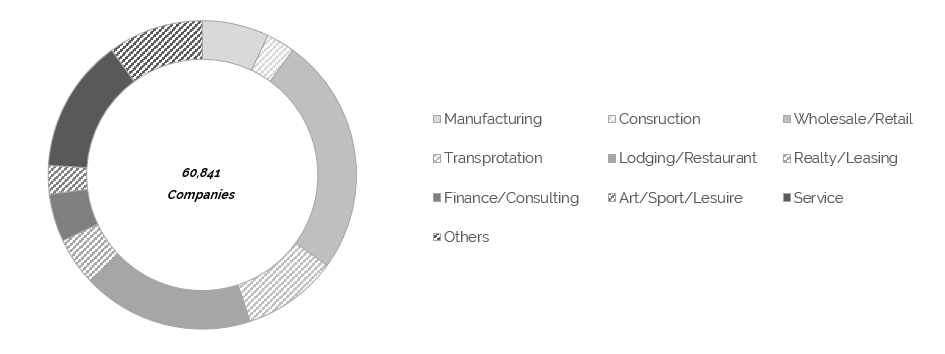

Seoul Pangyo, by creating favorable business environment, has successfully induced companies, including major conglomerates, mid-size firms and venture companies, to move in.

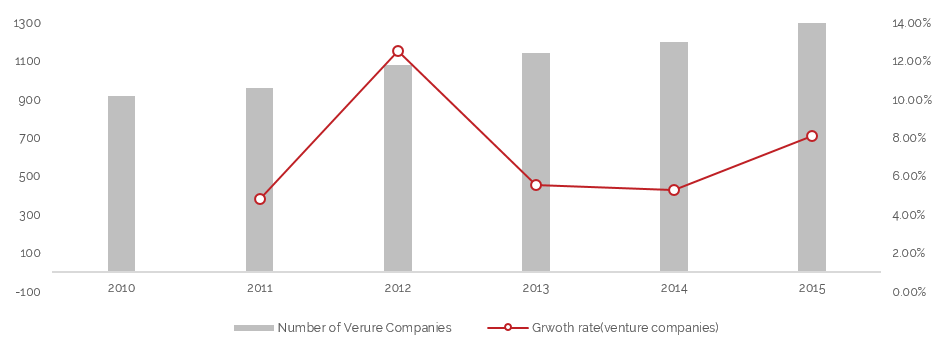

The industry of Seoul Pangyo have shown stable and continuous growth over the past years; the growth is expected to be continued, especially around BBD/Pangyo district.

The number of venture companies in Seoul Pangyo has been showing steady increase at a rate of 7.2% (CAGR); surpassed 1,000 as of 2012, reached 1,297 in 2015.

Companies and Employees(2010~2014)

Industry Sector Composition(2014)

Number of Venture Companies in Seoul Pangyo(2010~2015)

Currently, “Alphadom-City” and “The second Pangyo Techno-Valley,” two additional large-scale business complex developments are planned in Seoul Pangyo near the project site; Increase in demand for accommodation is forecasted.

Two major business complex developments are expected to spur accommodation demand from business clientele.

The second Pangyo techno-valley is a government-driven development, as the central part of ‘The Urban High-tech Industrial Complex Development Plans’.

The complex composed of MICE, office, retail, cultural and lodging facilities is currently on the stage of planning; the construction is expected to begin in 2018.

Alphadom-City

|

Land Area | 137,498m2 |

| Gross Floor Area | 1,219,173m2 | |

| Total Project Cost | KRW 5.03tn | |

| Period of Project | 2007~2018E | |

| Main Tenants | Samsung C&T, Hyundai Department Store | |

| Facility Composition | Office, Housing, Lodging, Retail, Cultural facilities |

The Second Pangyo Techno-valley

|

Total Area | 130,000py |

| Total Project Cost | KRW 1.5tn | |

| Period of Project | 2015~2019E | |

| Main Target | R&D Centers of Global Companies |

Beakhyun Urban Development Plan

|

Location | Area around 1, Jeongga-dong, Bundang-gu, Seongnam |

| Land Area | 206,280m2 | |

| Project Goal | Development of MICE Industrial Cluster | |

| Facility Composition | Exhibition, Office, Retail, Clutural, Lodging facilities | |

| Period of Project | 2015~2022E | |

| Form | Joint Business of Public and Private Sector |

Incheon, Suwon, Goyang, and Ansan are major metropolitan cities located near Seoul, with similar characteristics to Seoul Pangyo -self-sufficient cities with growing industries.

Suwon city, which is located adjacent to Seoul Pangyo, has well-established industry on the basis of conglomerates’ research complex, which led to a high demand of accommodations; Suwon City’s accommodation facilities far outnumber other metro cities’.

Seoul Pangyo, which was once developed as a Bed town to absorb excessive housing demands of Seoul, is currently growing into a self-sufficient city by the absorption of business relocation demands of Seoul.

Major Cities in Metropolitan Area

| Incheoon──── | Population: approximately2.93 million |

|

Main industry: As a port city, Incheon is famous for ocean industry and export trade and has the Free Economic zone such as Songdo. Especially the machinery industry is active around the industrial complex. |

|

| Swon──── | Population: approximately1.18 million |

|

Main industry: Major institutes, such as Meteorological Administration, Rural Development Administration, National Geographic Information Institute, are located in Suwon. In addition to conglomerates’ research institutes(e.g.Samsung, SK), lots of businesses with more than 100 employees are located in the area. |

|

| Goyang──── | Population: approximately1.03 million |

|

Main industry: Traditionally famous as a representative manufacturing area of the metropolitan area. But after the development of Ilsan Newtown, service industry is also active due to the change in industrial function and increases in land prices. |

|

| Ansan──── | Population: approximately0.7 million |

|

Main industry: 99% of the businesses in national industrial complex comprise of small and medium-sized businesses. The establishment of the industry focuses on Steel, electric electronic, machinery, petro chemistry. |

Compared to other major cities with similar characteristics, Seoul Pangyo appears to have relatively few hotel facilities and rooms; Also, currently there is no Luxury-scale hotel in Seoul Pangyo.

Compared to other major metropolitan cities, number of hotel facilities and rooms supplied in Seoul Pangyo are far less than average.

Currently, Seoul Pangyo has only one Deluxe (4-Star) Hotel, and has no Luxury-scale (5-Star) Hotel.

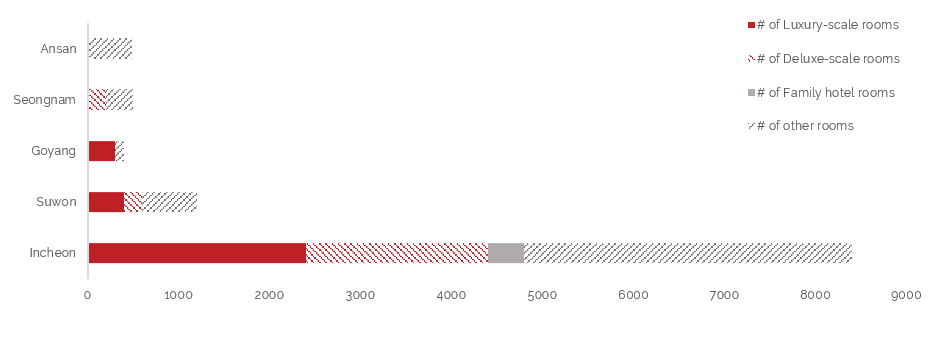

Major Cities in Metropolitan Area

Number of Rooms in Major Cities by Hotel Scale

Compared to other major cities, Seoul Pangyo appears to have relatively few hotels and rooms. Both indicators –the number of businesses per hotel room, and the number of population per hotel room, indicate the insufficient supply of accommodation facilities in Seoul Pangyo.

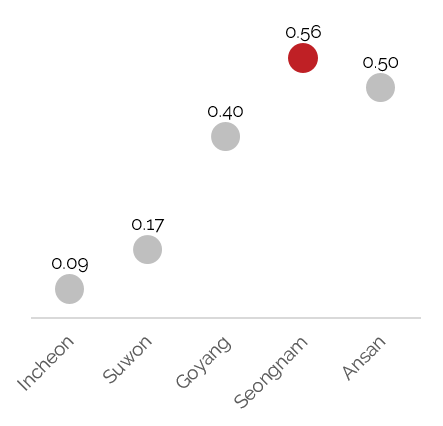

Indicator : Businesses to Room

|

The number of medium-sized businesses in Seoul Pangyo has been showing a steady growth over the past years; 5-year CAGR of 8.69%. The number of business per hotel room in Seongnam-si is 0.56, which is the highest among major cities; implies insufficient number of hotel rooms considering the city’s industry scale. |

Incheon | Suwon | Goyang | Seongnam | Ansan |

| Rooms | 8,528 | 1,884 | 489 | 735 | 722 | |

| MediumSizedBusinesses | 752 | 313 | 194 | 411 | 359 | |

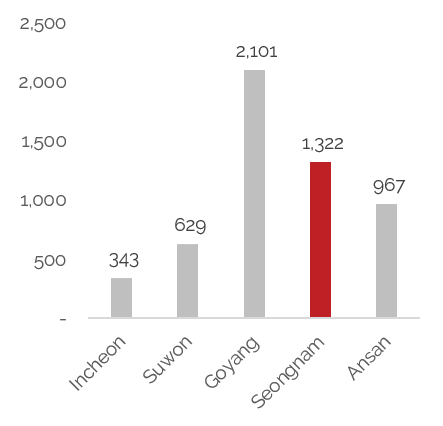

Indicator : Population to Room

|

The number of people per hotel room in Seongnam-si is 1,322, which is higher than Incheon/Suwon/Ansan by x3.9/x2/ x1.4; another implication of insufficient supply of hotel rooms compared to other cities. |

|||||

| Incheon | Suwon | Goyang | Seongnam | Ansan | ||

| Rooms | 8,528 | 1,884 | 489 | 735 | 722 | |

| Population | 2,925,815 | 1,184,624 | 1,027,546 | 971,424 | 697,885 | |

| Company name | BESITZ Comprehensive Development CO., LTD. |

| President | Kim, Hye Jung |

| Establishment | February 26, 2004 |

| Location | 11th Floor, amcosquare720, 14, Eonju-ro 85-gil, Gangnam-gu, Seoul, S.Korea |

| Tel / Fax / E-Mail | +82 (0)70 4170 6919 / +82 (0)2 554 4438 / info@besitz.co.kr |

| Business type | Type : Real estate industry |

| Main Business | Trade businessLeasing real estateConsultingReal estate development work |

| Organized team | Strategic planning, Architecture, Law, Accounting |

| 2014. 02 | Hanmoo ConventionProposal for Selection of GKL Foreigners-only Casinos | |

| 2012. 11 | Korea Federation of Teacher’s AssociationsThe Korea Federation of Teacher’s Associations Building Remodeling Business | |

| 2012. 09 | Soongsil UniversityDevelopment Project of Soongsil University complex Facility | |

| 2012. 06 | Korea Asset Management CorporationSchool Facilities Complexation Plan Using National Property | |

| 2012. 01 | Gimpo city hall (local gorvenment)Development Project of Gimpo Taeri Korean Style house Complex | |

| 2011. 10 | Chungnam Techno ParkDevelopment Project of Chungnam Techno Park Knowledge Industrial Center | |

| 2011. 05 | TIMAHDevelopment Project of Bangka and Belitung of Indonesia | |

| 2011. 02 | Enis Co. Ltd.Development Project of Jeju Myosanbong Tourist Region | |

| 2010. 11 | Incheon Free Economic Zone AuthorityInternationalization Strategy of Songdo Landmark City | |

| 2010. 10 | MasdarFeasibility Study and Master Planning on Construction Masdar New Town KCTC of UAE | |

| 2010. 10 | Korea Asset Management CorporationResearch on the Development Plan and Efficient Management of Small National Property | |

| 2010. 09 | OAO KAD-LDevelopment Project of Russia Project KUDROVOⅡ | |

| 2010. 09 | Korea Electric CorporationBusiness Basic Plan on Optimum Utilization of South Branch Site of Korea Electric Power Corporation | |

| 2010. 08 | Hanam Urban Innovation CorporationDevelopment Project on The Cheonhyeon and Gyosan District Eco-friendly Multiple Complex of Hanam-city | |

| 2010. 07 | Gumi city Hall (local gorvenment)Utilization Plan on The Kumoh National Institue of Technology Site | |

| 2010. 03 | SKTELECOMResearch for the Plan for an Index of City Management | |

| 2009. 10 | Chungnam Techno ParkDevelopment Project on Construction of Cheonan Valley Mansion Type Multiple Complex | |

| 2009. 08 | Korea Institute for Advancement of TechnologyResearch on the Long-term Development Strategy and Progress Plan of Korea Techno Park | |

| 2009. 06 | Korea Asset Management CorporationResearch on the Utilization Improvement of National Land |